36+ co signer requirements for mortgage

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad 10 Best House Loan Lenders Compared Reviewed.

Do I Need A Cosigner For A Mortgage The Ascent

Get Instantly Matched With Your Ideal Mortgage Lender.

. Ad Tired of Renting. The lender also must give you a document called the Notice to. Web A co-signer takes full responsibility for paying back a loan along with the primary borrower.

Web The cosigners role is strictly on the loan application and not with ownership of the property. As a co-signer on a. Web Cosigners do not get property rights to the home and cannot sell the home if you default.

Income and assets are verified and the cosigners credit and job history are. Web The process for cosigning a mortgage is the same as applying for a regular mortgage. With a Low Down Payment Option You Could Buy Your Own Home.

Web 38 of co-signers end up having to pay some or all of the loan. The co-signer is obligated to. Estimate Your Monthly Payment Today.

Why Rent When You Could Own. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. With a Low Down Payment Option You Could Buy Your Own Home.

Comparisons Trusted by 55000000. The cosigner must sign all loan documents except the security instruments to. Ad 10 Best House Loan Lenders Compared Reviewed.

Ad More Veterans Than Ever are Buying with 0 Down. USDA loans typically require an applicant to have at least a 640-credit score. In some cases a co-signer is a family member or friend of the loan applicant such as a.

Web USDA loans also have unique requirements when it comes to co-signers. To be eligible a cosigner must have a family relationship with the primary. Web A co-signer should have better credit and income than the primary borrower.

Often a co-signer will be a family member. The loan with the highest amount. Web Typically a co-signer on a mortgage will be a parent spouse friend or a family member.

But there arent clear limits on who can co-sign for a mortgage. Why Rent When You Could Own. Web To qualify as a cosigner youll need to provide financial documentation with the same information needed when you apply for a loan.

With a Low Down Payment Option You Could Buy Your Own Home. Lock Your Rate Today. Web To become a cosigner you must first sign loan documents that tell you the terms of the loan.

Basically anyone who is an adult 18 or 19 in Canada with a solid income and credit history can co-sign a mortgage. Get Instantly Matched With Your Ideal Mortgage Lender. Your credit score your income and your debt to income ratio.

Comparisons Trusted by 55000000. When you go in to apply for a mortgage with a bank or other traditional. Co-signers generally need to have a credit score of 700 or higher.

For co-signing you need to. Web To co-sign a mortgage is to put your name on a mortgage as a guarantee against a loans primary borrower failing to keep up with payments. Web There are three areas that need to be checked to be able to qualify for a mortgage.

A good credit history and high credit score at least 660. Web So the best way to qualify as a cosigner and help the home buyer secure a decent mortgage is to have. Ad Tired of Renting.

With a Low Down Payment Option You Could Buy Your Own Home. Web A cosigner with a steady paycheck and low debt-to-income ratio DTI may give the lender assurance that someone will be able to make the mortgage payments. Web A co-signerusually a relative or friendis someone who typically doesnt live at the property aka a nonoccupant co-borrower This person physically co-signs the.

Web What are specific mortgage co signer requirements. Lock Your Rate Today. Web A co-signer is someone who meets the lenders qualification requirements and agrees to repay the debt if the primary borrower is unable to do so.

Web Cosigner Requirements For Becoming A Mortgage Co-Signer What credit score does a cosigner need. Compare offers from our partners side by side and find the perfect lender for you.

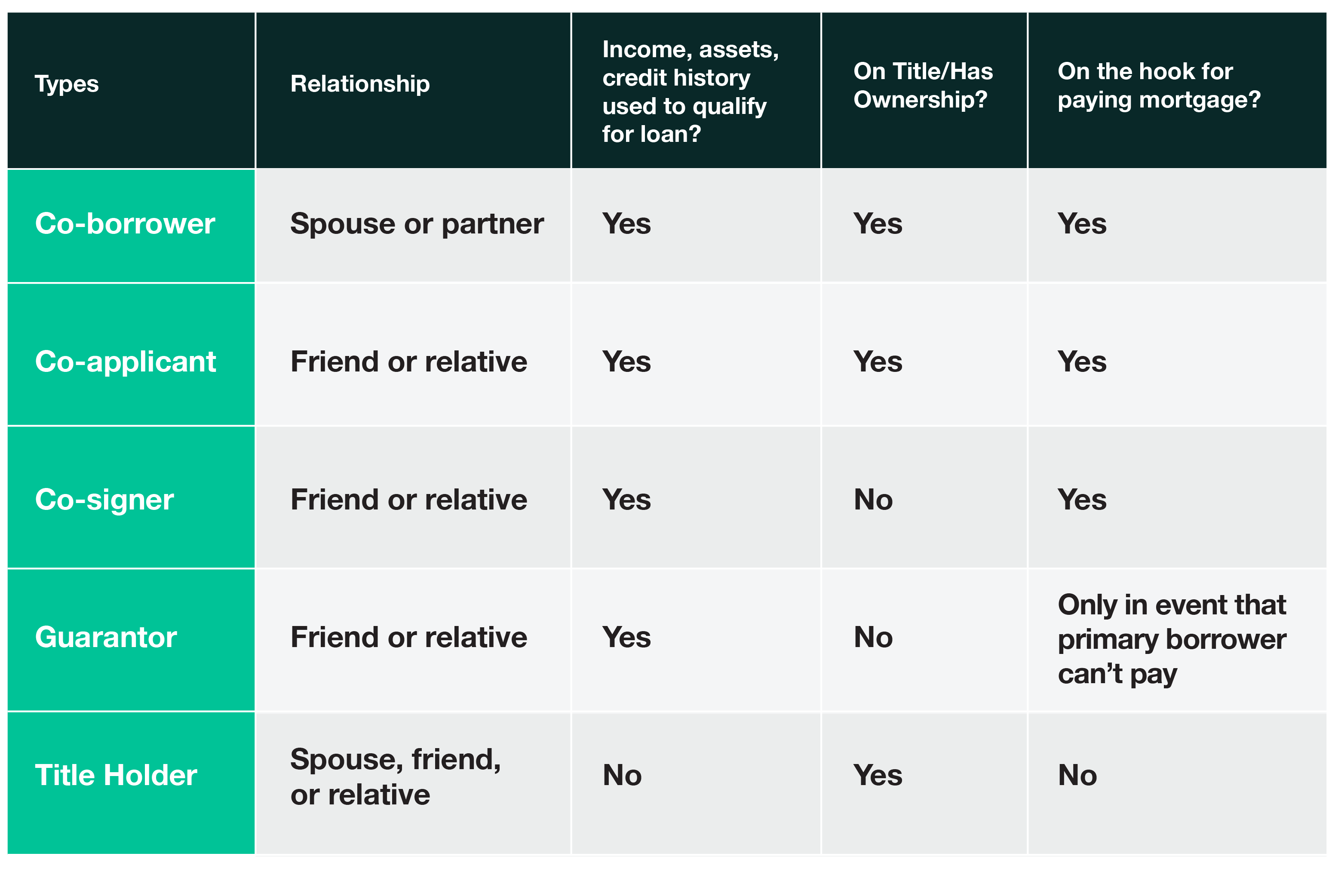

Co Borrower Vs Co Signer Which Should You Use On Your Loan Forbes Advisor

Business Succession Planning And Exit Strategies For The Closely Held

How A Mortgage Co Signer Can Help You Buy A Home

What You Need To Know About Late Mortgage Payments Lendingtree

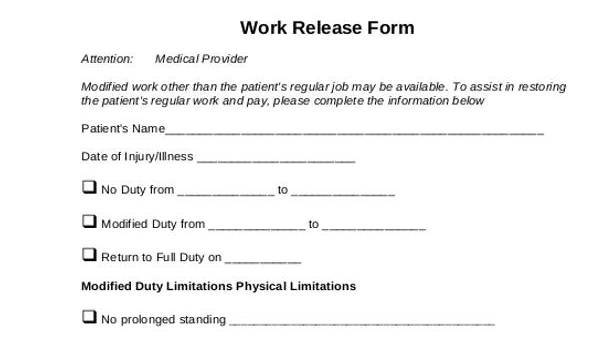

Free 36 Generic Release Forms In Pdf Ms Word

Proptech Study By Proptech Switzerland Issuu

How Mortgage Co Signing Works Howstuffworks

Need A Co Signer Or A Guarantor Know The Difference Canadian Mortgages Inc

Cosigning A Mortgage Loan What To Consider Lendingtree

What Happens If A Cosigner On A Student Loan Dies Debt Com

Application Requirements Formatic Property Management

What Is A Reverse Mortgage Money Money

Should You Add A Co Borrower To Your Mortgage Better Mortgage

How To Build A Real Estate Website In 2023 Step By Step Guide

Very Often The Tatiana Mikhailova Mortgage Broker Facebook

03887 Nh Real Estate Homes For Sale Redfin

Cosigning On A Mortgage Things You Need To Know Loans Canada